Understanding Google My Business & Local Search

Google and Apple Consolidate Positions in Driving Directions During 2013

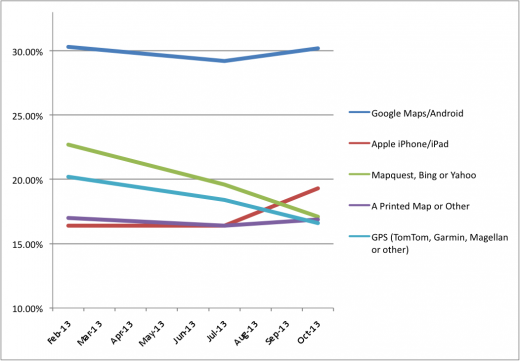

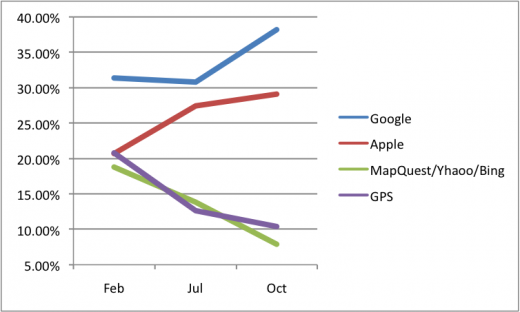

The driving directions market, while more fragmented than search or social, is continuing to see consolidation. Google maintained their leading share and Apple gained share while the GPS and other web providers are seeing steady and large declines in usage.

Over the past year, I have continued to survey consumers as to their preferred choice in driving direction platform. Surveys of roughly 3500 individuals were conducted in February, July and October of this year. The surveys were done via Google Survey and the results are representative of the adult US Internet population with a margin of error of ~+ /- 2%.

The survey takers were asked: What product or service do you normally use to get driving directions?

Apple saw a nearly 3% increase in share starting the year at 16.4% and ending it at just over 19.3%. Mapquest/Bing/Yahoo lost 5.6% and GPS lost 3.6% of share. An increase in “other” (not included in the first survey) made up the offsetting gains.

Driving directions seem to be a tool that once adopted are unlikely to change in older populations. That was born out with most users over 35 particularly in the older age cohorts. Google and Apple showed strong gains in the 18-24 year old group. Google however has small losses to Apple in most other age cohorts with Apple showing strong gains in the 25-34 year old group as well. GPS and Mapquest/Bing/Yahoo each lost over half of their share in the 18-24 year old group with GPS losing significant share in the 24-35 cohort as well..

Clearly the numbers reflect the rapid movement to mobile for this activity and away from the desktop and dedicated devices for the task. This is particularly true in the critical younger demographics where a long term behaviors are just being established.

The gains in consumer usage made across the board by Apple, while coming mostly at the expense of GPS and non Google desktop incumbents, reinforces that fact that their Map fiasco is behind them. Whether it was true or not at the time of introduction, apparently large numbers of iPhone and iPad users are finding Apple Maps adequate for the task.

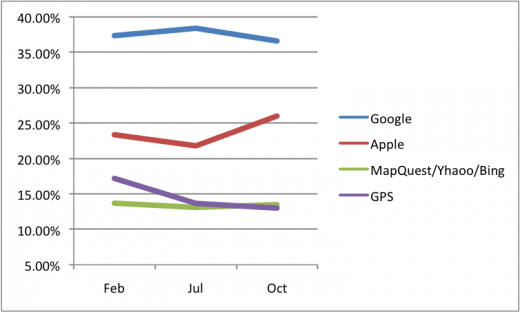

The driving direction market remains fragmented and if you look at the numbers from the point of view of the primary map data suppliers it remains competitive with Google and NavTeq (most GPS , Mapquest, Yahoo) each holding about 30%. TeleAtlas, which appeared to be a lost cause a little over a year ago has moved into a strong third. Navteq, not having a strong consumer facing product showing growth, could be at risk going forward.

The consumer side appears to be moving fairly rapidly towards a bipolar world of Google and Apple. Unless there is a new portable category or some unforeseen event occurs in the mobile space this trend is likely to continue.

It will be interesting to see how the holiday purchases, which are likely to have favored Google and Apple, will further impact shares.

© Copyright 2024 - MIKE BLUMENTHAL, ALL RIGHT RESERVED.

Comments

1 Comment

Ongoing interesting survey. On a side note, Mike, I suppose about a year or longer ago, around the time A Maps came out I was asking customers of some of our smb’s what mapping technology they used to find our smb’s and different businesses.

One interesting anecdotal piece of info was that people were using the installed apple maps on their Iphones regardless of the uproar over the problems.

Some knew about the problems…some didn’t. Just interesting. Meanwhile if Apple gets 25 – 50 % of mobile over time it has this astonishing market share that could possibly be the biggest threat to market control by google over elements of search.

Its not the search…its the device. How interesting.

Comments for this post are closed.