Understanding Google My Business & Local Search

How Accurate is Google My Business Insights?

The scuttlebutt in the world of Local SEO has long been that Google Insights was inaccurate and unhelpful as a guide to consumer behaviors. But is the newish Insights a better guide? How accurate is it and how can we test it?

Prior to the rollout of the Google MyBusiness dashboard in June of 2014, the original version of Insights was most certainly a piece of crap. Data would disappear or change, the product would not report for weeks on end, it would display spurious and unbelievable spikes. In fact at one point years ago, when I inquired of Google about the old Insights as to how some given data point was measured, I was told that the person who had coded it had left and they had no idea.

The Insights that rolled out in 2014 seemed to me, at least anecdotally, more robust and reliable if not perfect. I had gained at least enough confidence to use the information as a directional guide and felt comfortable that it was accurate enough for client consumption and for decision making.

But was it accurate? Many in the industry continued to diss the product but no one has really bothered to test it. Most of the data that is shown in the dashboard is captive to Google’s environment and largely unknowable. Only they really know what goes on with users interactions with search, the Knowledge Panel, the Local Finder and maps. If they don’t share it, we can’t really know.

How could we test Insights?Last week I asked myself the question: Was there a data point within the dashboard that could be measured in some other way?

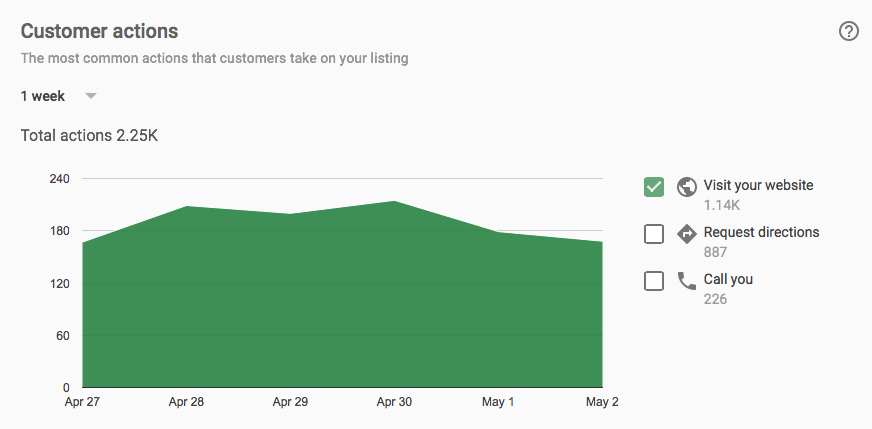

The answer is yes, there is one (and one only as far as I can tell) Insight metric that can be externally measured and that is Customer Actions: Visit your website. With a campaign tracking code you could at least compare Google’s value for that metric in Insights with their value in Google Analytics1.

What did I find? That the accuracy of Google Insights seems to be quite good. The number from the GMB dashboard for Visits is very close to the Analytics number for that campaign.

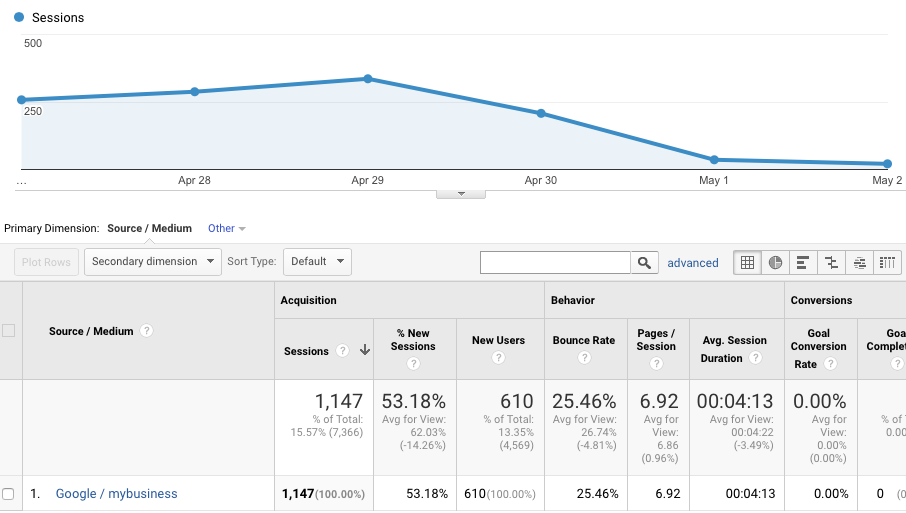

The GMD Dashboard showed a figure of 1.14K while Analytics for that same period showed 1,147 sessions occurring from that campaign source.

So I have several questions for you.

So I have several questions for you.

Firstly are you seeing the same thing in terms of web visits being the same? Now that we have 18 months of Insights data you should be able to go back and look over a long period.2

Secondly can you think of another way to externally measure the accuracy of Insights?

Thirdly is your faith in GMB Insights increasing or do you still distrust the product?

Does a strong showing in one area (web visits) mean that the other areas like click to calls and driving directions can be trusted?

1 – Certainly there are issues using this as the benchmark. If they are cooking the books then they would have to do so across two products. While not impossible, it is much harder. It is conceivable that they are using the same exact data as Analytics.

2 – I do not have a long data set to share unfortunately.

© Copyright 2025 - MIKE BLUMENTHAL, ALL RIGHT RESERVED.

Comments

24 Comments

Footnote #1 is testable. One could remove analytics from their site and rely on other mechanisms to measure visits, then re-add. Though, in every version I saw of insights, they were pulling directly from logs, not GA codes.

@Joel

I see no reason to think that they are cooking the books. And any analytics has problems at the most granular level.

What I would be more interested in is being able to independently asess the trustworthiness of the data in Insights. Can it now be trusted as an ongoing metric and used for decision making? If it is flawed how is it flawed and is it flawed always in the same, predictable way? Are there places that your listing shows that they aren’t tracking? What is the criteria for a click to call to register?

For historical reasons it’s gotten a bad rap… is that warranted or can we move on?

In another smaller sample I was looking at, Insights was undercounting web visits compared to Analytics.

It would behoove Google to be both more transparent about what goes into Insights now that we can all see 18 months of data.

Joel:

Thanks for the comments. I haven’t looked at logs in a long time. I used to periodically check. I should go back to them.

I’ve always found GMB data or all of its predecessor names to be distorted or controlled in such a way as to not be deep helpful. More of a tease than hard usable data. That is enormously distressing. Google controls all the information and only doles out what it wants. I can’t think of another business or industry where that is allowed.

I’ll have to check our multiple sources to see if there is any accuracy to this data. I’ll get back to you.

The one piece of data that I currently find remarkably distorted across the board for multiple websites is the Where Customers Find you graph that breaks things down by Direct and Discovery Searches.

I have keyword data that goes back to way before google hid keyword data. I have very extensive adwords data. I also glance at webmaster data to the extent it might have some value….

In our cases, the Direct Traffic has to be 3 times or more overstated and the discovery element has to be understated by the inverse.

Then we speak with our customers. These are the buyers (who virtually all visited our sites). They are a subset of the visitors to our sites. Overwhelmingly they found us through discovery searches that vastly outnumber what google is showing us in that graph. Look we have small niche businesses. They don’t have enormous name recognition. We believe our data in that graph across the board is widely distorted.

Why? Well immediately below some of the google description on this data is a call to advertise using Adwords Express!!!!

Ahhh. Google is an advertising media that secondarily provides some ever diminishing search opportunities.

How long has google provided this “special data” to small businesses that claim their businesses with google?? 8 years, 10 years??? Its never been good. Why should I believe it now?

Honestly I’ve spent a lot of years working on web marketing for a series of smb’s and assisting some business owners that I know. Its amazing how clueless they are and then its remarkable how larger web marketing entities pick on this cluelessness to pull wasted marketing dollars on them.

I find it difficult to acknowledge there is good data coming from GMB insights when its been so crappy, so manipulated for so long…and in its current form it provides this direct-> discovery ratio that I find remarkably overstated.–then followed by a call to advertise.

Give me a break.

Mike – Is tagging the URL in the GMB dashboard recommended, like you did here, for tracking? Does it cause impacts to rankings? I thought in the past it was frowned upon.

@Ashley

You are right that at some point in the past using campaign URLS could hose the local listing. Google sometimes banned it if you used the word Google in the code, sometimes they choked on the Url and I am sure that there were other issues. But that was 2012 timeframe. At least for the past two years or so, it has been fine.

Hi Mike,

Good article and research. I found similar stats with my website clicks while I’ve been tracking my GMB as well. What I don’t think is accurate is the “How Customers Search” and “Where Customers View” based on 2 things:

1. How do we know?

2. This section used to be labeled as “Impressions”, which is essentially the same thing as it is now. That data was always inaccurate to me. Google would say you had X impressions but would never say what that meant, where the business was showing, etc.

I do think phone calls are fairly accurate as well, though the only way to test that is to put a CTN on GMB. That would not be ideal. You should test that…..

Side note that I’m seeing a new GMB dashboard today for businesses with more than 1 listing in the GMB account. The menu bar is moved to the left hand side. I’ll screenshot and throw on Twitter.

1. How do we know?

2. This section used to be labeled as “Impressions”, which is essentially the same thing as it is now. That data was always inaccurate to me. Google would say you had X impressions but would never say what that meant, where the business was showing, etc.

It is true that Google has not been totally transparent in providing stats. Nor do we actually know the sources of some of them. But that is true in Analytics as well and yet we mostly accept those new data points as accurate or at least accurate enough.

One of the reasons I wrote this article was to attempt to surface what we knew about Insights about what we just thought.

Someone on Twitter did comment on their use of call tracking and noted that Google, because they were counting clicks, not actual calls on the CTC was over counting mobile and undercounting desktop calls.

There is a way to use a Call tracking number to better understand GMB calls without messing up your listing is add your real number as the secondary number to Google and the CT # as primary. That might goof up Moz but otherwise its a functional way to do it without screwing up your NAP.

Interesting take on the CTN. I didnt realize using a CTN wouldn’t confuse Google if the secondary number was there as well.

I have always had a very skeptical view of Google’s “Insights”. And I was quite surprised, no stunned, a few months ago when I compared GMB reported website visits with both Google Analytics and host data from several client sites as well as my own and found that the numbers correlated very closely.

Still, the largest “Action” for virtually every client in Insights is “Photo views”. Really? Your kitchen is underwater and you Google a plumber for a pressing need NOW and you peruse photos? And he only has a few photos on his GMB page meaning that the average user who clicks his listing on the knowledge panel is going to look at multiple photos? Hmmm, me thinks not.

I have noticed that recently, though photo views are included in the Actions on the dashboard “summary”, they are no longer a metric within Insights. Now it is just website visits, driving directions, phone calls. That’s progress, I suppose.

Clients have always liked to see their “Insights”, even after I have warned that “your results may differ”. But they get it. They like the graphs and charts. Trot a full blown GA traffic, user behavior, etc. reports on them, their eyes glaze over. They don’t get it.

So if the client likes it, I like it too. I like it even better when I can walk away with at least a semblance of confidence that what they are seeing is real. For the actions that really matter (site visit, directions, calls), I feel more confident that these numbers are at least somewhat realistic. But as long as I keep seeing hundreds of monthly “photo views” of plumber’s butt cracks… Hmmm.

I like Jim’s comments above: Especially the final 2 paragraphs. Quite telling. Clients like GMB insights, especially the presentations with graphs and charts. Clients “don’t get, or their eyes gloss over GA data provided as is”. If GA data is “better” or more valuable I guess you have to represent it in a way where the client absorbs it better.

I went back and did check one smb with a separate coded GMB page for separate data:

Overall: In one month

Over 3,000 total visits from google per GA (haven’t checked logs)

GMB visits per GMB and GA about 450

Total organic (non paid) visits (GMB and organic) over 2,000. ie GMB provided over 20% of the total non paid visits.

Over 1200 ppc visits. Of those over 800 were from mobile ads. The ads comprised almost 50% of the total for mobile. (Cripes that is a lot and its expensive)

Mobile ads generated more visits than total GMB visits.

My quick take away is that a lot of organic visibility including organic under the pac and organic in non pac serps are very valuable. The more relevant content that shows the more traffic. Mobile advertising is Astonishing. Ads suck up traffic.

(at least that is the take away for one smb in one vertical)

Now that is valuable. I still find the graphs that. We are reworking our organic/pac efforts and advertising efforts to respond to those findings.

On some of the other GMB data I simply don’t get it and its either not valuable or misleading. But it is in GRAPHIC FORMAT. Eye catching.

The top thing GMB shows is that graph suggesting Direct or Recovery Traffic vs Discovery Traffic. Its the top piece of DATA. I guess Google thinks this is deeply important and wants to highlight it.

RANT TIME If its so important SHOW US KEYWORDS. I get keyword data from adwords. I can also see truncated and somewhat “nutty” or not very applicable keyword data from Webmaster Tools (the google console). The “nutty”/not applicable data has to do with keyword impression data that is nationwide and not local.

But regardless, even without adwords data I get some context from Webmaster Tools.

In any case for some reason completely unexplained and not defined Google is showing roughly 3 times the percentage and I guess volume of searches as being Direct/ or branded.

Its not true. Its overwhelmingly FALSE. We’ve tracked this for over a decade. Before Google stole keywords from smb site owners. We’ve tracked it via adwords. We see it via Webmaster Tools.

Then we do more. We do what you did Mike, in your marketing analysis of the effectiveness of marketing campaigns for the Buffalo Jeweler. We speak with our customers. We’ve spoken to thousands of them. There is an enormous difference between customers that discover us by name and by the vertical. It skews enormously toward those that do a discovery search (vertical) and simply don’t know us.

So that graph is way off. I don’t know why they are sending us that data, what it means, how they “interpret” recovery/direct searches.

Methinks they want to either skew the information or they don’t know what they are speaking about. What do you think???

Below that percentage graph is one that suggests how people are “seeing us”. I wish they would DEFINE what seeing us means. We saw about 6800 searches where we show and we saw about 2200 maps views. 2200 Maps views???? What the heck is that??? Our people searching for something in our neighborhood and our little smb shows on the map??? We are a tiny niche business with overall very little consumer interest. When I do a maps search in the neighborhood for that smb I find almost 40 different points of interest on the map!!! We are one and we are certainly not mainstream.

On the 6800 search visits, that comes close to what we see in adwords for impressions. Our adwords phrases include phrases that don’t generate a pac….but its close. BTW: We also advertise in Bing and while the total activity/impressions and clicks is overwhelmingly smaller than google….the types of phrases are similar with dramatically fewer recovery/direct searches than the google graph would represent.

Do those maps views have value??? Probably not. Every time for over a decade for more than one of our little smb’s when we get tremendous visibility for something irrelevant to people’s intent on our services…we get nary a lead!!!!! By nary I mean probably below 1/10 of 1 percent. Maybe lower.

Below that is the data about visits to the site which include GMB visits. It appears per your finding, Jim’s above, and mine this might be accurate.

FINALLY. Something that seems to be “checkable” and might be accurate.

As both seo and small business operator, from an operations perspective I have yet to see real value in GMB insights. We reach and struggle to find real valuable data.

If I’m looking for shiny reports, per Jim its nice. But is it helpful? I don’t see it. I actually see information that is mostly suspicious.

GMB shows is that graph suggesting Direct or Recovery Traffic vs Discovery Traffic.

They aren’t going to give us Keyword data but they should at least give us mobile vs desktop data.

Do those maps views have value??? Probably not.

I think that the value, while still small, has increased and will increase over time. It is most likely recovery not discovery data. But it would be useful to know that re the first point.

FINALLY. Something that seems to be “checkable” and might be accurate.

My question to all if we trust Analytics and yet, when we do find accurate points in Insights we still are skeptical. I am not sure that makes sense. All analytics have flaws but I assume that Insights is no more or less flawed than Analytics.

Where I think the problem comes is Google’s total lack of transparency beyond the graphs.

I have yet to see real value in GMB insights. We reach and struggle to find real valuable data.

For me the piece of valuable data is the number of calls coming from Google that are not seen any place else. It should be relatively easy to vet that number with a decent call tracking set up. I will see if I can find more on that.

With the combination of a campaign URL in GA and lead tracking through a third party on the website, we don’t really ever use GMB insights. I do feel that they have been more accurate than in the past, but still unnecessary with our other tracking measures. It’s an interesting tool to keep an eye on for sure, just not in our day to day use at all.

@Danielle

That tells you who came to your website and from where but it does NOT tell you how many people have take action elsewhere to get in touch.

I’ve measured over 1,000,000 actions on my GMB insights tool since January and I can tell you for sure, the #1 most inaccurate stat on GMB is Phone Calls. They only represent a fraction of what is actually happening in the real world since GMB only does click to call on mobile devices… so anyone who reads a number off a desktop display and then dials the business from their cell phone, is not getting attributed.

With that said, I’ve compared GMB with Analytics and do believe it to be highly accurate for website clicks as well as all other insights. I truly believe that the direction request stat (for businesses that get those) are a great way for a business like a restaurant, hotel, office space, doctors office, etc to gauge how accurate it is… When our office space clients for example host a workshop or event, we ALWAYS see it correlate with a direction request spike… it’s not random, it’s a reflection of the real world. Same thing with Restaurants, they can tell us when their busiest day was of the month and it’ll almost always line up in GMB with the day that had the most views and or direction requests. And for our seasonal clients, now that we have a solid years worth of data at the daily value, we can see the reflection of the change in their market through the views on search and maps. (rising and falling with the season although “rank” is unaffected)…. heck, we can even almost predict when a business is going to go under based on their GMB insights trend… ALMOST.

I’ve also find that that Views on Search are a direct representation of the number of page 1 impressions a business is receiving since technically, a GMB listing, can’t generate a search impression without being in the top 3 of the local pack (or for a direct search)… so when a business has 80-90% of impressions coming from “Discovery” and a higher ratio of search vs maps views, it tells me they are ranking higher on the GMB pack… or inversely, if they get a lot of map views, it can sometimes mean that most of their users are mobile as I see this more in major metro areas like NYC, SF, Miami, Denver, etc.

For those who believe that consumers just do discovery searches and make their decision on that singular search concept… they have that backwards. To me “Direct” isn’t a bad thing… often times, and I do this personally, I often end up searching for a business directly when I am ready to convert, often after finding them in a discovery search initially… so that could even be considered your “conversion rate” to a degree (the ratio of direct vs discovery).

Because every consumer behaves differently, it’s hard to say from business to business how accurate GMB insights are, but after building my own tool and using it as the primary KPI of my maps management program, I have to say, GMB insights might be the most underutilized statistic in the industry. You simply can’t ignore what it really says after you break it down and analyze the search funnel more granularly.

There’s even a way to see the keywords driving direct and discovery with a few webmaster tools filters and some ingenuity

The best part… it works both ways!! Ironically, the only customers I ever have cancel, are the ones that the numbers never really grow in GMB with. Any client that i’ve had who has seen their GMB traffic rise, has also reported to me that in the real world, so has their businesses traffic and sales.

Just my $0.02 on the topic.

Evan

Thanks for the input!

My Analytics and GMB are very different. Granted we don’t get a ton of traffic, but Analytics is half the website visits that the Insights on GMB gives us. Is there a reason for that?

Laura How are you measuring GMB visits in analytics??

Any ideas if there have been any big changes to Google listings display or ranking in search and maps? I ask because of changes I noticed on some of our 4 listings (when looking at “Where customers view your business on Google” graph).

1 listing had a gradual improvement about a quarter ago, which was sustained after that. Then over a month ago, it jumped up about doubling itself for views of “Listing on Search” and it sustained that. Then just last week, it jumped up in “Listing on Maps” more than doubling that. At first I ascribed this to a natural rise after having an office move to a new address there back in April.

Another listing was consistent, but then just last week had a relatively huge rise in views of “Listing on Maps”, something like ten-fold. I tried comparing this with our business data related to in-person traffic and didn’t see anything really corresponding.

Our third listing had moderate increases the past 2 weeks for “Listing on Maps” views.

Our fourth listing may have had very small increases but is not nearly as noticeable. It seems mostly steady with maybe slightly increases in views of “Listing on Search” over the past few weeks.

@Mike

Google did an update to their local algo in the early june (th or ) timeframe that might have helped the business that moved… it essentially rewarded businesses in higher traffic area.

We have multiple brick and mortar locations separated by 60+ miles, each with its own GMB page. As Google recently began allowing call-measurement-numbers to be used, I installed a unique number on each location’s GMB page..

This allows accurate call conversion monitoring, and, allows direct comparison of GMB “Reported Calls” versus “Actual Calls”.

Results show that Google REPORTS LESS THAN 55 PERCENT OF CALLS that originate on our GMB pages.

I think this is a gross discrepancy, and, it should be corrected by Google as soon as possible.

The “click to call” that Google reports only measures mobile interactions since those are the ones that actually click.

We have seen situations where they account for as few as 25% of the actual calls although 50% is a pretty solid and conservative estimate.

In speaking with Google about it, they are aware of the undercount.

Maybe at some point we will see a more accurate number but for now, if you aren’t using call tracking it’s safe to estimate the actual number by doubling what Google shows.

Mike, I don’t understand your assertion:

“The “click to call” that Google reports only measures mobile interactions since those are the ones that actually click.”

Are you saying that desktop users can’t click active phone links on GMB pages? I must misunderstand you because that’s plainly incorrect.

It may be that Google does disregard clicks from its own “Phone” fields; that must be for reasons other than desktops being unable to “click” on active links.

Well I suppose that a desktop user can technically click to call IF they have their iPhone or skype set up to do so…. but very few do…. most pick up the phone and call. We know from call tracking studies that almost all just dial the phone.

It is those calls that are not being tracked and if you count all of those then the actual calls coming from the Local search is somewhere between 2 and 3x of what Google reports via Insights.

Comments for this post are closed.