Understanding Google My Business & Local Search

Yelp’s 2013 Results and the Headlines that Weren’t

Yelp announced their 2013 “earnings” last week. I am continually shocked by the rosy headlines and the lack of due diligence often present in the reporting.

Some of the more egregious examples of uncritical coverage:

- Yelp Pushes Through The Controversies With Big Growth And A 5-Star Quarter

- Yelp shares jump 17.5% on solid Q4 results

- Management Says Yelp Is Just Getting Started

- Yelp Shares Surge 7% On Rosy Outlook, Q4 Loss Narrows

- Yelp Shares Climb on Strong Q4 Revenue, Guidance

Some were more neutral but still carried an uncritical tone or hints of positive results.

- Yelp Reports $233 Million In Revenue For 2013, Up 69 Percent

- In Yelp Earnings, No Sign of the ‘Mobile Gap’

Few if any of the headlines that I found were critical with but one exception.

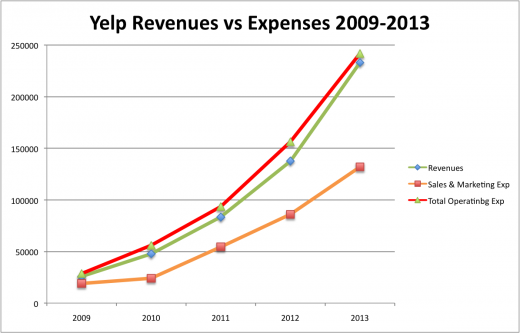

Here is a chart showing Yelps Revenue Growth compared to Expenses over the past 5 years. I am having trouble seeing a reason for optimism. This has been the same story for many years. See for yourself.

I would suggest that the headlines should have been:

- Yelp Reports 5th Consecutive Annual Loss

- Yelp reports 20th Sequential Unprofitable Quarter

- Yelp, No Profits in Sight as Expenses Rise as Quickly as Income

I think they all must have failed to read Yelp’s forward looking statement buried at the bottom (embarrassingly formatted exactly as on the report).

Factors that could cause or contribute to such differences include, but are not limited to: the Company’s short operating history in an evolving industry; the Company’s ability to generate sufficient revenue to achieve or maintain profitability, particularly in light of its significant ongoing sales and marketing expenses; the Company’s ability to successfully manage acquisitions of new businesses, solutions or technologies, including Qype and SeatMe, and to integrate those businesses, solutions or technologies; the Company’s reliance on traffic to its website from search engines like Google, Bing and Yahoo!; the Company’s ability to generate and maintain sufficient high quality content from its users; maintaining a strong brand and managing negative publicity that may arise; maintaining and expanding the Company’s base of advertisers; changes in political, business and economic conditions, including any European or general economic downturn or crisis and any conditions that affect ecommerce growth; fluctuations in foreign currency exchange rates; the Company’s ability to deal with the increasingly competitive local search environment; the Company’s need and ability to manage other regulatory, tax and litigation risks as its services are offered in more jurisdictions and applicable laws become more restrictive; the competitive and regulatory environment while the Company continues to expand geographically and introduce new products and as new laws and regulations related to Internet companies come into effect; the Company’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities.

© Copyright 2025 - MIKE BLUMENTHAL, ALL RIGHT RESERVED.

Comments

8 Comments

Good fact-finding, Mike.

It’ll be interesting to see how that deal with Yahoo fits into Yelp’s plan for profitability (if there is one). At first blush, it seems like two drowning swimmers grabbing at each other’s heads.

Mike: For a variety of reasons I’m not that down on Yelp, as I sense you are. Clearly your article has flushed out some recurring continuous issues; their finances for one.

For several years yelp’s financial issue seems to be that it costs them A LOT to earn money. They have to invest a lot into a sales force, that has a tough nut to crack to sell ads. It was the case several years ago and its the case today. To me, that is the big financial hurdle.

As to the “forward looking statement” All businesses write forward looking statements that read in that manner. They are designed to articulate risks and issues with businesses. There is nothing unusual, scary, or out of the ordinary at all with the forward looking statement in yelps financials.

Read a lot of them. They all look more or less familiar. But the graph you portrayed is of course a great example of their long term financial hurdle. How do they make a profit with such high costs to sales?

A different example would be opentable. Their sales costs as a percentage of revenues is much lower. They have a compelling reason to purchase, their revenues off of selling their services is much higher than yelp ad sales…and they’ve shown a profit for several years.

Google, on the other hand virtually doesn’t have to have a sales team. Google does not have a sales team of feet on the street, or via phones. What an enormous advantage and an opportunity to turn revenues into profits when you can sell…without having to pay much of a sales force. That is a unique benefit most businesses don’t have.

On an information basis I like and find yelps reviews and info superior to google’s. They provide one page with complete information. For instance prices. If I want to see if a restaurant has good reviews or not and what is the general price range in terms of $ or $$ or $$$ or more I can find it on one page in yelp. In google I have to go to the reviews page for reviews and the google + page for prices. Do customers or users know that? I doubt it. Google has separated very critical info and hasn’t broadcast that info. But it is the type of info people want.

Yelp has a deservedly crappy reputation among business operators. They earned it. While I’ve fielded a lot of sales calls from Yelp I’ve never been strong armed by their sales team. So many others have reported it. I believe the many reports. But I (we) have taken a lot of their sales calls over the years and never once experienced that. If we had I’d report it. I have a big mouth!!!!

As you’ve noted what they have to sell is somewhat dubious. Ads, that include placing their ads on competitors sites. Of course google placed links to competitors on their various “local pages” over the years as you know. On top of that their basic ad costs are high on a per view basis. On the other hand, because customers tend to read yelp when they are closer to buying that gives them a reasonable argument for that pricing.

But yelp does get traffic. When we have a business with a relatively high ranking for discovery terms (not just branding) we see a lot of yelp traffic coming our way.

Yelp is used by consumers. It has to be the most well known, most trafficked review site on the web.

Yelp, as with all web businesses is reliant on its rankings in google. Therein lies the rub. It would not surprise me if google felt threatened by yelp, or had a problem with its revenues or anything else, google could change its “algo’s” and yelp’s high rankings could plummet.

But yelp is so tiny relative to google. Incredibly microscopic relative to google, as are most websites. Its traffic and revenues are microscopic compared to google. It is not a threat.

There should be more alternatives to google, in the local realm. Its really in the health and best interests of businesses to survive. That is a general business “best practice”.

Yelp keeps reporting that its traffic from mobile apps is growing significantly. Good for them. As a business it makes them less reliant on google. That is a generally healthy situation for any business…don’t be reliant on one source of business or leads.

Generally with google’s tremendously dominant position I believe its healthy for smb’s in general to have more choices, more options on traffic, more, sources of leads, more variety than if everything is googlecentric. yelp is one of those sources.

I do wish they would reverse direction and figure out a way to both sell and be “more business friendly” in their approach than they have in the past. That might be a boon for yelp and would be a big boon to businesses. But that is for them to figure out.

I will emphasize though, that as a web site that adds to the framework of how customers get to view smb’s they provide a large source of reviews, they are trafficked a lot because of that, and that makes them important.

Dave

Yes these are generally available on all reports but they do often hold the truths while the earning presentation is often a case of slight of hand . That is the case here.

I am not criticizing Yelp in this article, although there is plenty to criticize. I am suggesting that the reporting has been overly lax and lacking appropriate context.

the Company’s ability to generate sufficient revenue to achieve or maintain profitability, particularly in light of its significant ongoing sales and marketing expenses;

Is but one of the forward looking (and backward looking) statements in the piece that reporters should have used for the context of their reporting. Just because every company is required to report forward looking statements does not make them useless in understanding a company’s concerns and getting some real insight into their thinking. Unlike the 5 slide deck that is ALL happy talk.

This article is not about whether Yelp can send traffic to an SMB.

The core focus of this piece is whether Yelp is able to monetize that profitably over time. The chart suggests that they have not been able to do so up to this point. The question for reporters and analysts is to make a case why they should be able to in the future. None of them did that I could see. And yet they write glowing articles lacking any critical insights as to why they are so positive.

I believe that reporters have an obligation to not just be PR people.

Mike: Thanks for responding. I think all forward looking statements by law have to discuss risk factors. For instance, the following is just the table of contents to google’s forward looking statements from a 2012 financial. At the beginning it references legal requirements for a “forward looking statement”

Its pretty long. I’ll touch on some topics concerning your article and our discussion before the “boiler plate/legalese with regard to “forward looking statments”

As to yelp’s potential for profitability: The graph you showed, which essentially shows that SGA (selling, general and administrative costs) have pretty much remained at about 50% of revenues, is deeply telling. If you looked at the financials for ReachLocal, (RL) a google “partner” reseller of adwords to local smbs one would see a completely similar situation: SGA has consistently remained at about 50% of total revenues. Its situation is very similar to that of Yelp. Both have grown revenues a lot. Both have been unable to hit profitability.

Interestingly, RL is an example of google’s “feet on the street” effort, directed toward smb’s. They repackage and resell adwords. They tend to mark up adwords at 2-3 times the actual cost of adwords, as has been reported in many cases.

Like yelp they have to live off of a sizable sales force. I have an idea as to why these two businesses have not been able to materially change their profitability even as revenues have risen, and why that ratio of SGA to revenues is stuck at around 50% quarter after quarter, year after year.

I’m betting, guessing and suggesting its churn. I think these types of businesses have a pay program for sales wherein the commission percentage of a sale is VERY HIGH relative to the first months or few months of a clients’ spend. Thereafter the commission on revenues drops dramatically.

If that were true, (and it is a fairly typical kind of commission program for sales driven companies) then the ability of two businesses, Yelp and RL to move to profitability would depend on keeping clients over the longer term, and not suffering from “churn”. Neither company is required to report churn in their financials. Neither does.

Having to rely on a “feet on the street” sales team is evidently expensive. Maintaining customers over the longer haul is possibly a great way to mitigate early month heavy sales expenses.

That might be one of the reasons (but not all of the reasons) that an OpenTable (OT) is able to show SGA that is about 25% of revenues (also it earns considerably more per customer) than a Yelp or a RL. OT seems to retain customers.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements regarding:

•

the growth of our business and revenues and our expectations about the factors that influence our success and trends in our business;

•

seasonal fluctuations in internet usage and traditional retail seasonality, which are likely to cause fluctuations in our quarterly results;

•

our plans to continue to invest in systems, facilities, and infrastructure, to increase in our hiring and provide competitive compensation programs, as well as to continue our current pace of acquisitions;

•

the potential for declines in our revenue growth rate;

•

our expectation that growth in advertising revenues from our websites will continue to exceed that from our Google Network Members’ websites, which will have a positive impact on our operating margins;

•

our expectation that we will continue to pay most of the fees we receive from advertisers to our Google Network Members;

•

our expectations about the impact of our acquisition of Motorola Mobility Holdings, Inc. (Motorola) on our results and business and our ability to realize the expected benefits from the acquisition and successfully implement our plans and expectations for Motorola’s business;

•

our expectation that we will continue to take steps to improve the relevance of the ads we deliver and to reduce the number of accidental clicks;

•

fluctuations in aggregate paid clicks and average cost-per-click;

•

our belief that our foreign exchange risk management program will not fully offset the exposure to fluctuations in foreign currency exchange rates;

•

the increase of costs related to hedging activities under our foreign exchange risk management program;

•

our expectation that our cost of revenues, research and development expenses, sales and marketing expenses, and general and administrative expenses will increase in dollars and may increase as a percentage of revenues;

•

our potential exposure in connection with pending investigations and proceedings;

•

our expectations about our board of directors’ intention to declare a dividend of shares of the new Class C capital stock, as well as the timing of that dividend, if declared and paid;

•

our expectation that our traffic acquisition costs will fluctuate in the future;

•

our continued investments in international markets;

•

estimates of our future compensation expenses;

•

fluctuations in our effective tax rate;

•

the sufficiency of our sources of funding;

•

our payment terms to certain advertisers, which may increase our working capital requirements;

•

fluctuations in our capital expenditures;

•

our expectations about the timing of disposition of the Home business;

as well as other statements regarding our future operations, financial condition and prospects, and business strategies. Forward-looking statements may appear throughout this report, including without limitation, the

David

Simple question.

Do you think that this headline

Yelp Pushes Through The Controversies With Big Growth And A 5-Star Quarter

Is a fair and balanced summary of the current Yelp financial report?

Mike:

As an smb operator I don’t really care about their financials. Its advertising. If they closed shop I’d stop paying a monthly fee.

I do care about traffic and visibility. In my experience, as a non restaurant operator, when an smb operator gets some yelp reviews their page manages to rise to the upper level of serps. When that occurs there is a significant amount of traffic relative to other sources. In our experience its much less than google, and marginally less than other SE’s but its large compared to other sources.

If one has positive reviews on yelp it appears to be very oriented toward conversions. Positive reviews on G + or yelp, or other review sources are invaluable.

If I have to decide as to where to put advertising monies their relative financials are one of the last things I’d consider.

Now as to how the press writes about the financials of businesses….frankly from an smb perspective I don’t care. As an investor I’d care…but not as an smb operator.

Most financial press is as thin as you pointed out on the yelp story. You found one article that focuses on the continuing dilemma of margins.

I referenced RL earlier. They have the same financial dilemma as Yelp; their margins haven’t changed appreciatively even as their revenues have grown.

I haven’t looked at financial press about them but Google recently gave them an award. http://www.reachlocal.com/google

Google is creating positive press about a business that tends to charge more for advertising per smb/ than does yelp, and has a long track record of scamming smbs and getting terrible reviews. My last experience in that regard was from 2013 wherein an smb found they had been double billing them for a period of time, and blocking that smb’s access to actual google ppc costs. That is ugly.

Now in terms of what works or doesn’t for smb’s I got wind of this new development:

A website owner that has a sort of b to b presence that is regional was pursuing adwords to help with visibility. Google is giving him 3 months of FREE adwords assistance in setting up his acct. To do so he had to promise to do a certain threshold of monthly spend.

I haven’t seen that broadcast. Have you? Have any of your readers?

I do a lot of adwords. I take the calls of google adwords experts. I find that they are helpful and informative. That is a real benefit to a website/ or business owner. It absolutely gives one a huge heads up on the learning curve for adwords. It evidently includes ZERO mark up…and you get both adwords and the benefit of their very strong informative reporting.

Oof. That isn’t good news for SEO’s that sell adwords services, nor is it good news for the google resellers. If it turns out beneficial to the website owners and google finds that it boosts revenues and doesn’t cost them much they can ramp that up pretty easily.

From an smb perspective, I don’t care about financial reporting. I care about it from an investor perspective, but historically its always been thin and not that substantive. OTOH, there have always been a few analysts and writers that dig deeper and with greater depth. From an investor perspective they are worth following….and/or just stick with Warren Buffett. He has a great track record.

Mike,

I also share your skepticism. However, Amazon also followed the same invest in the business strategy for the first 3-5 years of their existence by plowing profits into growing market share for online selling (at a low margin or unprofitable martin). In Yelp’s case, they are trying to grow credible consumer reviews, which have been driving consumer traffic . With consumer traffic comes advertiser revenue to follow.

Am I missing something here?

@greg

Several things. 1)it has been 7 years 2)yelp has no special technical advanced like Amazon and 3)they are not gaining any cost advantages as they scale. Their selling and marketing costs rise as fast as their income.

Comments for this post are closed.