Understanding Google My Business & Local Search

Google LBC Dashboard: Impressions of Impressions and Actions

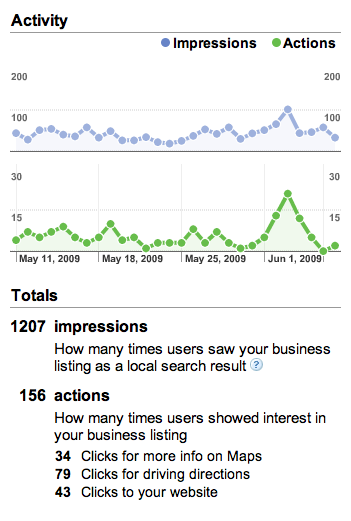

I was curious to get an overview of dashboard information to understand both the value of Google’s new Local Business Center Dashboard and to attempt to quantify the value of a Local Universal search placement. I have summarzied impressions, actions and the details of actions for 31 of the Dashboards that I have access to.

I was curious to get an overview of dashboard information to understand both the value of Google’s new Local Business Center Dashboard and to attempt to quantify the value of a Local Universal search placement. I have summarzied impressions, actions and the details of actions for 31 of the Dashboards that I have access to.

On average 6.12% of impressions amongst these 31 businesses generated actions of one sort or another.

The highest total impressions and the highest action rate was 12.9% for a jewelry business in a midsize city (280,000 pop) that advertises heavily on radio and televsion. Over 50% of the actions in her account were for driving directions which I assume is the “recovery” part of the transaction. By that I mean the searcher knew who they were looking for and were now interested in visiting her location. 21% of those who took action “clicked for more info” and 28% clicked through to the website.

On average 36% of total actions across all dashboards were clicks for more info on Maps, 24% were for driving directions and 40% resulted in website visits.

There was some correlation between market size and total impressions. However popular industry search segments like restaurants and real estate did relatively well even in very small markets. Unfortunately I don’t have access to numbers for any given market segment across multiple market sizes.

It is not clear from the dashboard whether a given user that clicked for more information within Maps also took another action. If we assume that all of the actions were discreet (not necessarily an accurate assumption) than 60% of the actions taken would not show up in your web analytics.

Last year, Steve Espinosa published some provacative statistics that indicated that a first place organic ranking generated 1.6 times as many web visits as a Local 10 Pack listing. The Dashboard numbers suggest that non web visit actions are 50% higher than web visits putting the relative merits of a Local 10 Pack listing on parity with a #1 Organic Listing.

Obviously these numbers are not perfect as they do not account for either untracked actions like phone calls or double tracked actions by the same searcher taking two actions but they do give a general idea of the range of results that one might see in typical business.

I would love to know what folks are seeing in their dasboards as to total impressions, actions and action breakdowns. Let me know.

© Copyright 2026 - MIKE BLUMENTHAL, ALL RIGHT RESERVED.

Comments

29 Comments

Interesting stats Mike. From what you say, it seems that all of your business listings have less actions than impressions – is that the case?

In some of my clients’ dashboards, I’ve seen it the other way around. One listing in particular has 917 impressions with 3548 actions. Still scratching my head on this one. At first, I thought that if a searcher clicked on “more info” in maps, then clicked for driving directions, then also clicked through to the website, that would be 1 impression with 3 actions.

I still believe this is what’s happening (some clarification from the G-maps team would be helpful – hint hint) but for the listing with 917 impressions, it only has 4 clicks for more info, 1 click to the website and 3,543 clicks for driving directions. I’m wondering about the accuracy of the data, and if similar listings’ data is getting merged in the dashboard.

I’m sure there are still some bugs being worked out. Regardless, I like the directions the LBC is going.

Hi Jim

I have not yet seen that happen. Obviously you are looking at a quirk in the system. I wonder how many others are experiencing the same thing?

I really like that data rich dashboard as well but I (as is my typical) would love more data…

-how many uniques generated how many actions

-what are the geo phrases being uses

-what are the details of “other” search queries

I’ve also noticed on a couple of occasions that there were more actions than impressions on a given day, but overall the data seems pretty reasonable. I’m not counting it as cast in stone yet, but I am happy to see more information than we had before.

In some cases I’m seeing is a startlingly high number of clicks for directions as compared to more info or clicks through to the website. One client’s numbers are as follows:

29 clicks for more info on maps

230 clicks for driving directions

27 clicks through to the website

Seems like an inordinately high number of people looking for this particular client by name in Google Maps for directions to their office.

I’m looking forward to seeing the information correspond with Analytics more accurately. Of those 27 clicks through to the website, I see one in Google Analytics – which tells me either that they’re all coming from the 10-pack listings, which are recorded as organic traffic, or it’s not tracking correctly.

All in all, I’m happy that the LBC is now providing additional data, and I’m looking forward to it being more accurate and comprehensive.

@Melissa

10 to 1 would be consistent with my estimates of number of times Local Universal Results shows vs a listing showing in Maps

[…] Look at LBC Dashboard By Greg Sterling Mike Blumenthal takes a look at 31 LBC dashboards and summarizes what he finds: On average 6.12% of impressions amongst these 31 businesses generated actions of one […]

Mike

hmm, did not notice more actions than impressions, but below are some of my numbers:

vacation rental (based on 10k impressions):actions 5.10%, “more info” clicks 33%, direct clicks to site 64%,

jewelry store – actions 4.75%,”more info” clicks 19%, direct clicks to site 70%,

It would be great if Google presented us actions broken down by keywords (like they do with impressions) also xsl export feature pls!

Also, we may see more business sign ups to LBC in the couple weeks. Google Base Blog is now asking merchants to use LBC and associate their LBC and Base data http://googlebase.blogspot.com/2009/06/local-business-information-and-store.html

this form can be used for associating Base with LBC: http://base.google.com/support/bin/request.py?contact_type=lbc

P

Mike, I’d also expect to see a higher rate of impressions in Universal Results vs. Maps. What I’m seeing is a higher amount of actions seemingly taking place in Maps, unless I misunderstood what they’re referring to as “Driving Directions.” Thoughts?

I’m glad you published this Mike. IMO this new package of statistics is both somewhat helpful, possibly somewhat misleading, and a partial view on what is happening when visitors find our local business websites.

Its helpful in the context that it shows shows us statistics and actions vis a vis the appearance of G Maps via searches. The searches can show up via either initiating a search in google.com (organic) or via maps.google.com (initiating a search directly in maps).

In fact, contingent on how a searcher chooses how to search…the information can be presented very differently.

Unfortunately we don’t know from these statistics whether the volume of impressions and then actions are initiated in google.com or maps.google.com. Right away that is a little disconcerting.

I assume the vast majority of searches are initiated in google.com. Old market research (pre the days when google inserted maps into organic searches) found that searchers initiated searches in maps at 1-2% of all searches in google.

I bet usage isn’t widely different at this time…and assume most of the searches I see are generated off of google.com (with maps inserts).

The statistics are presented in a shortened, truncated basis–and aren’t thorough.

We see what google personnel have described as the “what” part of a phrase ie the service/or products. We don’t know what geo modifiers are used, if any.

Furthermore we only see the top 10 phrases versus what any analytics product would show, with all the phrases.

My biggest problem is that the statistics shown are not based on what the business intends to be seen, what the marketing effort is shooting for…but instead is a function of the “categories” in which a business is placed by google maps.

I can’t speak for other webmasters. I know in my case….the categorization that shows up in maps is often surprising to me. So often it arises out of a great multiplicity of “trusted sources” such as YP’s, endless IYP’s, surprising sources, etc.

Sometimes the categories are totally inappropriate.

Now in my case I find the impressions being generated include some categories…I know from tremendous experience, are somewhat tangential to the main services but they don’t generate good results. That comes from years, even decades of experience. The categories aren’t focused enough. In some other cases, the categories are the result of totally inappropriate categorization. This probably came out of the process in amassing the data through what google calls “trusted sources”…but frankly…I don’t trust them at all….the categorization just was never correct.

Now I copied some data off of one of the businesses.

Something over 6,000 impressions in one month. A total of about 400 actions within google maps. That is about a 6-7% relationship of actions to impressions. Pretty low.

Of the top ten phrases shown in the dashboard 4 of them are “what” categories that we simply don’t focus on. They approximate about 1,000 impressions.

Frankly I never see traffic from these “what” terms in our analytics. I doubt they scarecely generate an action at all.

From a relevancy factor of the top ten I see about 5,000 impressions with the same 400 actions-> only a ratio of about 8% on “relevant phrases”. A little better. Not great…maybe not bad. I’m not sure.

I believe I’m fairly experienced in looking at this type of information. By education and experience I was a financial guy. I used to develop analyses that helped us better understand business actions.

We have owned some of the businesses in question for over two decades, including the one referenced above. We have tracked sources of leads for decades. We have experimented dramatically over many years–including advertising in categories that I now deem irrelevant.

We dropped things that didn’t work and kept the things that worked. Our web efforts reflect that. Our web advertising expenditures reflect that.

Of interest with a couple of businesses, including the one cited…I tracked the “what” categories that surprised me…with geo modifiers and that might be used. In what would be rare cases we could be in the ten pac. In most cases we were buried at #30 or lower.

Needless to say…with that kind of visibility, I’d expect the “return” statistics–to be lousy if they are skewed by many visits for “what” terms where are visibility is negligible…or where we haven’t made an effort.

Here is what I prefer to do to turn up meaningful statistics.

1. Advertise using ppc for exact terms, for all the most relevant phrases. Advertise using ppc for broad terms also.

For statistical purposes I’m only interested in stats on exact terms. Broad terms gives me data that is somewhat as shaky as the LBC dashboard.

2. Total up all visits to the site from analytics for the exact terms.

3. What is the percentage of visits to the site for the exact terms versus impressions for exact terms.

Then look at how the site is presented in google’s search terms for those exact terms.

Is there a maps presentation? Are we first, 2nd, 3rd whatever? Where are we in ppc? 1st, 2nd 3rd, buried?

Where are we organically?

Frankly that gives me an idea what I have to do to take a better percentage of visits from critical and volume oriented searches that are likelier to convert.

But in answer to the simple question…my response rate is about 6-7% or 8% depending on how you want to look at it.

Alternatively, when I look at things my way….in one wonderful case I found over 50% of the queries for what is the number one search phrase in volume to the site…within the vast geography in which we were advertising…were hitting our site. That was unbelievably great.

Alternatively because of organic and maps rankings for other important phrases…we were only capturing about 15-25% of the traffic.

Uh oh. those need work.

In any case valuable question to the community.

(at least that is my $0.02 of opinion.)

dave 😀

@Peter

What do you see at the implications of the Googlebase direction?

@Melissa

The very high driving directions are either 1)bogus numbers or 2)some bot digging through maps…not really sure but they don’t make lots of sense

@Dave…whew give me a few to digest that

Mike, et al:

Sorry to be so long winded. I have problems w/data from the lbc dashboard. I don’t think it is deeply meaningful. Garbage in…garbage out.

I’ll give you an example from a different business. Since this last weekend visibility on organic search has changed for the 2most important,relevant, voluminous, on-target, focused keywords.

Maps has changed the visibility.

I compared overall exact phrase traffic from analytics and google adwords to ascertain the impact over the last couple of days versus…May, 2009.

For one phrase (with a geo modifier)..visits to the site dropped from 37% of all exact phrases to 25% and for the other phrase (industry term w/out geo modifier…w/ maps being inserted on a geographical basis) we are down from 17% of all clicks to 12%.

Big problems. Ya know..one of our sales people told us calls have dropped over the last couple of days. Big problem.

The LBC dashboard doesn’t give me any insights into these specifics. Using analytics/ppc, etc. does.

Its why I’m not too happy about the package provided by the dashboard.

:D-> (that was a lot more succinct-wasn’t it, Mike?) 😉

Mike,

A few weeks ago Google Base started to ask merchants to submit their business locations ( http://twitter.com/PeterWyspianski/status/1935041947 ). We knew the Google team were up to something and that some sort of association between the Base feed and LBC might happen.

A few of my thoughts on this new development:

-It’s a clear push for LBC, Google is clearly trying to increase the awareness of LBC among businesses (new dashboard, now this)

-The association between Google Base and LBC might be another “trust” signal for a business listing in Maps (but obviously you will know better then me 🙂

– A new 8th tab for business listings in Maps? You can already associate your Base xml feed with your Adwords account (this is called the Adwords PlusBox: http://searchengineland.com/google-continues-adwords-product-plusbox-16466 ) We can assume that something similar could be rolled out to Maps. I could see how a coupons option in Maps could be nicely tied together with the Base feed.

It’s also worth mentioning that not just product feeds can be submitted to Base, you can also submit pretty much anything (real estate listings, reviews, etc).

These are just some of my thoughts and predictions about the subject, obviously we will have to wait and see how things progress

p

I have a client with the same sort of results Jim has. Twice as many actions as impressions and virtually all of them are for driving directions. Makes me wonder/worry about the validity of the rest of the results.

I warn businesses that this is merely a marginally appropriate form of statistical analysis. There are far better methods to ascertain how a business shows in Google and how well it is doing. I would use it only as an additional piece of information…with some possible insights that might add a little help.

Let me give a different example than above. A smaller business w/ less impressions in a smaller metropolitan market.

1399 impressions in a 30 day period per the dashboard: 107 total actions with 53 clicks to the website through maps. The other 54 actions included 19 driving instructions and 35 visits for more information in the LBC. That is a 7.6% “action” response, based on the maps dashboard data.

The “what” business term that generated the most impressions is also the most appropriate and #1 business term in the industry.

Per keyword analytics I saw at least 257 clicks to the website for the “what” phrase. (I did not review the very very long tail of search phrases–there were more). I assume the 53 clicks in maps referenced above are included in 257 clicks.

I looked at my ppc statistics.

Advertising on a broad basis…the major “what term” showed over 1300 impressions. Some of the long tail click throughs of the 257 referenced above…represented those long tail phrases. Google Maps only showed 559 times w/ my business. That is somewhat enlightening.

My business site is showing for many applications of appropriate long tail search in organic google….and Google Maps doesn’t even show the business.

Conclusion. I better work on optimizing the site for organic and for maps; two different processes. In fact…is it really possible that Google Maps..which is dedicated to focusing on local businesses…is only working at less than 50% of the relevant local searches…when the key “what” phrase is being utilized.

That is revealing.

Finally I looked at “exact phrase” advertising for 3 variations of the business and site. One phrase represented the search phrase without the appropriate city (geo) modifier. One exact phrase showed the geo modifier before the “what phrase”. The other showed the geo modifier after the “what phrase”.

There are only 2 competitors in this market.

This really surprised me. There were more impressions shown in advertising via Adwords for the combination of those 3 dominant and most important search phrases…than Maps was showing TOTAL SEARCHES/Impressions for the key what phrase.

What gives? Is Google Maps not showing this business for appropriate searches? Is it hurting us and eliminating choices for consumers?

Seriously, WHAT GIVES? Its scary…because within the Web googles control of total search is what would have been considered a monopoly in years past…when the government tried to control monopolies because of the potential negative impact on consumers.

In sum:

I don’t care about my Google Dashboard action statistics. Its a very limited view on how my website is doing with regard to google itself.

Secondly, I have serious questions about how and where Google Maps is showing….I’m not sure its as widely relevant to local businesses as it should be.

Thirdly….is my business not getting all the views/impressions it should…for the most relevant term. If so, why not?

If I’m a business person–checking out this new delightful package of statistics in the LBC….I’d suggest….don’t rely on it. Get some more meaningful information to help you ascertain your visibility on the Web…and with Google in particular.

Great points Dave.

While one shouldn’t rely on this data it is a look, albeit limited, at user actions that never, ever show up in your analytics. The question about clicks for directions and click for more info is

-Are they reasonably accurate (hmm we could test that)

-What do they really mean?

Mike

[…] worth nothing that Mike Blumenthal wrote a very detailed post attempting to quantify the value of Google’s Local Business dashboards and I’d recommend giving it a […]

I wonder about these dashboard results. Something smells funny. For the latest 30 days, I had 605 impressions and 287 actions. An ungodly number, 228, were for driving directions. (44 direction requests from a strange location in another state.) 46 clicks for more map info and 13 clicks to site.

Not even the top search queries look right. According to the top search queries, 11 people actually typed in just my first name (a very common name). And I’m in the highly competitive mortgage business.

It will be helpful when Google gets it right. The data appears useless right now.

@Harold

There have been a few reports of obviously over counted driving instructions. Its not clear whether it is bad counting or perhaps a bot go thru for some reason.

Thanks for the feedback Mike. On the positive side, it is free and there is nothing to lose. So I am still pleased with the fact that I’m in there already. And I failed to mention I get tons of phone calls. There must be a lot of people not even clicking on the site link – which seems unusual. I find all this so interesting to follow and figure out.

I have had quite a few people ask me about helping them do what I did with Google Local. I would like to help, but can’t stop to invest the time to help everyone due to the cost of time. In your opinion, is there a viable business concept for just helping small business with all the facets of Google Local? Wouldn’t want to get involved in major across-the-board SEO. Would like to simply focus on SEO for Google Local. Maybe adding other local search options. Would such a business model be too thin?

Your expert opinion would be much appreciated.

Thanks

@Harold

There surely is.

Mike

Great, thanx. I will look into it further.

Whilst it’s great that Google are adding more features, I think they are jumping the gun.

The local search is just a complete shambles, certainly here in Australia anyway. For example, you can’t search “web design ….. ” now and get a full listing. At one stage they removed “security …. ” as a category and now it’s back again though.

But the biggest issue is the gaming of the local search engine. I set up one client for local search and he couldn’t understand why his opposition had eight listings in the local search area. It was simply because the business had listed “all suburbs” and one suburb as the address. This is so blatant it’s almost more transparent than adding text full of keywords to a page in the same color as the background, yet there are heaps of examples of the same thing.

So Google, go to it with the bells and whistles by all means, but make the search returns better for a start!

Cheers,

Ric

@Ric

Thanks for providing info as to the on the ground reality in Australia. I, as you know, take a critical look at Google as well. In this case, I think the dashboard is a carrot in their effort to encourage smb’s to claim their records. Claiming adds a level of security to the system and limits to some extent abuses. It also gives Google someone to kick out for bad behavior. They claim to be working on developing tools that will “innoculate” local from these abuses but it has yet to clearly be functioning here or in Australia.

Time will tell if they are on the right track and have the right priorities. Clearly a lot needs to be done to make Local work.

Mike:

I had one LBC account that wasn’t showing impressions. Yesterday it started to show impressions dating back one week. All along it had shown actions. (wierd, eh?) I had noticed on twitter that Joel H from Google Maps referenced an update with the dashboard.

Bravo. One small step for Google…one small step for dashboard followers. 😉

I still think it is a medium to poor quality statistical picture of actions and effectiveness with regard to one’s website.

Of note, I will say that one thing it doesn’t measure, nor do other web analytics are calls to a business based on visibility within Maps, and specifically within the map insert into Google.com.

Of course if you utilize a tracking phone number in conjunction with the maps record then you have a terrific tracking tool. Without that though, I notice when maps rankings for a site improves, we both get more visits to the site for subject phrases and we do generate more phone calls–even without a tracking number. 😀

kudo’s to Google for the update. Now if only they could provide some CUSTOMER SERVICE!!!!!

Dave, you hopeless romantic you.

[…] crops up in the forums is why would your Local Business Center dashboard all of a sudden show 0 impressions for your business listing in Google […]

This must be a quirk or a miss by Google. In one of our dashboard accts 4 of the top ten phrases show a related business term, but include the inititials of the state in which the business is located.

In 3 cases the initials are at the end of the phrase and in one case the initials are at the beginning of the phrase. Meanwhile I note where 2 potential higher ranking phrases w/ the state initials and the most relevant business phrase are clearly not showing…with that business phrase showing lots of impressions….but of course no breakdown.

I suppose its a small mistake in Google’s aggregating this data and sending it out to people w/ an lbc claimed listing.

The “non geographic” context of this tool is not foolproof at this time.

[…] nuance is the value of a #1 organic ranking compared to being in the 10-pack (since the 10-pack appears above the #1 ranking). It looks like what used to be assumed was a […]

Mike: This is old news. Nobody is going to see this but you. I didn’t think much of the value of the dashboard when it first came out and every so often I see more tidbits that suggests its statistical tool that should be ignored on the aggregate level. It might provide tiny tidbits of information but the overall package is worthless.

Today I took a look at the 7 day total for a business account with little activity at this time of year. Amongst the listings in the top ten were 3 references to the name of another business referenced in tiny place within our business site in a manner entirely irrelevant to what drives traffic to our site. How are we showing in Maps for that phrase.

I searched by name for that other business in G Maps. Our reference to this business includes neighborhood name. There we were in G Maps somewhere in the 30’s or 40’s. The G maps reference pulled the reference from our website with business and neighborhood name.

Does that have relevance to our efforts to get strong maps presence for phrases that are of value and reflect user intent. Absolutely not.

How many times in the category in Maps referenced “other” below the top ten references, does our business show for such obscure and unrelated comments. Is there any analytical benefit to getting this info. Should I take actions based on that?

I think not.

OTOH, I get benefit if I take a look at the major categories for the LBC dashboard, and if I’m running Google Adwords ads with full coverage and exact phrase ads. Then I can cross reference exact phrase ads against phrases in Google Maps.

When I cross referenced the time period from the dashboard against data from my google adwords account I saw that the total volume of impressions for the exact phrase ad for the what is the number 1 industry term (without a Geo modifier) was about twice the number of impressions for the phrase in the LBC dashboard.

Then I totaled the number of impressions for the exact phrase PPC ads which include a geo modifier and the term that is number 1 in the industry, which simultaneiously showed as the number #1 volume term in the LBC dashboard.

It turned out number of impressions in the dashboard closely approximated the aggregate number of impressions for the combination long tail search phrases that include a geo term and the industry number 1 term.

Conclusion: Google isn’t running versions of Maps for industry terms that don’t include a geo phrase. They might be running maps for some types of terms. They aren’t running generating maps for the 50% of searches that don’t include a geo modifier.

Interesting. It doesn’t tell me much about how I’m doing in Maps. It gives me information on when Google is and isn’t running maps and specifically that it isn’t running Universal Search Maps for the search terms without geo modifiers.

Hmmmm….those maps were a neat experiment during 2009. They seem to be fading now. Actually that doesn’t surprise me. I think for a variety of industries they probably moved searchers looking for local practitioners from hitting local PPC ads to hitting the record/site link associated with the Map.

In any case, I didn’t like the presentation of data in the LBC dashboard last year, and I still don’t think much of it. I think its greatest value is in cross referencing the limited information it provides with other sources of information such as analytics for your website and/or ppc data.

Hey I need your help

My Local listing is showing 0 impressions but 47 actions

Generally impressions are higher than actions

How this thing can be possible please reply me on email

Comments for this post are closed.